AMGEN (AMGN)·Q4 2025 Earnings Summary

Amgen Beats on Revenue and EPS as 18 Products Hit Record Sales

February 3, 2026 · by Fintool AI Agent

Amgen delivered a strong Q4 2025, beating Wall Street estimates on both revenue and earnings as the biotech giant's broad portfolio of medicines drove double-digit growth for the full year. Revenue of $9.87B topped the $9.46B consensus by 4.3%, while Non-GAAP EPS of $5.29 exceeded estimates of $4.73 by $0.56 (+11.8%).

CEO Robert Bradway struck a confident tone: "Amgen delivered strong performance in 2025, with double-digit growth in revenues and earnings per share. We enter 2026 with momentum across a broad portfolio of medicines and a clear path towards advancing innovative therapies to deliver sustained long-term growth."

Did Amgen Beat Earnings?

Yes — and it wasn't close. Amgen posted its seventh consecutive quarterly beat, continuing a streak of outperformance that began in Q2 2024.

Full-year results were equally impressive:

The slight margin compression reflects Amgen's aggressive R&D investment (+22% YoY to $7.2B) to support its robust pipeline, particularly MariTide and other Phase 3 programs.

What Did Management Guide?

Amgen's 2026 guidance came in at or above consensus, a positive signal for investors concerned about biosimilar competition to Prolia and Xgeva.

The guidance implies essentially flat-to-modest EPS growth at the midpoint, as Amgen absorbs biosimilar headwinds to Prolia and Xgeva while investing heavily in pipeline advancement.

⚠️ Q1 2026 Caution: Management explicitly flagged a seasonal headwind to Q1 sales driven by benefit plan changes, insurance reverifications, and higher patient copay obligations. They expect "lower mid-single-digit year-over-year growth in the first quarter" for total company revenues. Additionally, ~$250M of inventory build in Q4 2025 could impact Q1 sales, with Otezla and Enbrel expected to follow their historical pattern of lower Q1 sales.

How Did the Stock React?

Amgen shares closed down 1.8% during the regular session at $338.59, but rallied +1.7% after hours to $344.32 as investors digested the beat and in-line guidance.

The muted initial reaction likely reflects:

- Concerns about 2026 guidance implying limited EPS growth

- Prolia/Xgeva biosimilar headwinds called out by management

- Otezla impairment charges ($1.2B) related to IRA Medicare price setting

Over the past two years, Amgen has beaten earnings 7 out of 8 quarters, with the lone miss in Q1 2024. The stock has rallied from $261 (52-week low) to $353 (52-week high), currently trading near the upper end of that range.

What Changed From Last Quarter?

Several notable shifts emerged compared to Q3 2025:

Accelerating Growth Drivers:

- Repatha continued its momentum, up 44% YoY in Q4 (vs. +34% in Q3), driven by landmark VESALIUS-CV Phase 3 data showing 25% reduction in cardiovascular events

- TEZSPIRE maintained 52% FY growth trajectory as severe asthma franchise expands

- IMDELLTRA reached $627M in annual sales, up from $234M in Q3 run-rate

Emerging Headwinds:

- Prolia sales declined 10% in Q4 as biosimilar competition begins

- Xgeva sales fell 6% for the full year, with management flagging accelerated erosion in 2026

- Enbrel continued its decline, down 33% for the full year

Pipeline Updates:

- Rocatinlimab development terminated; program returned to Kyowa Kirin

- Bemarituzumab dropped in first-line gastric cancer after FORTITUDE-101/102 Phase 3 trials

- Six MariTide Phase 3 studies now enrolling globally

Segment Deep Dive

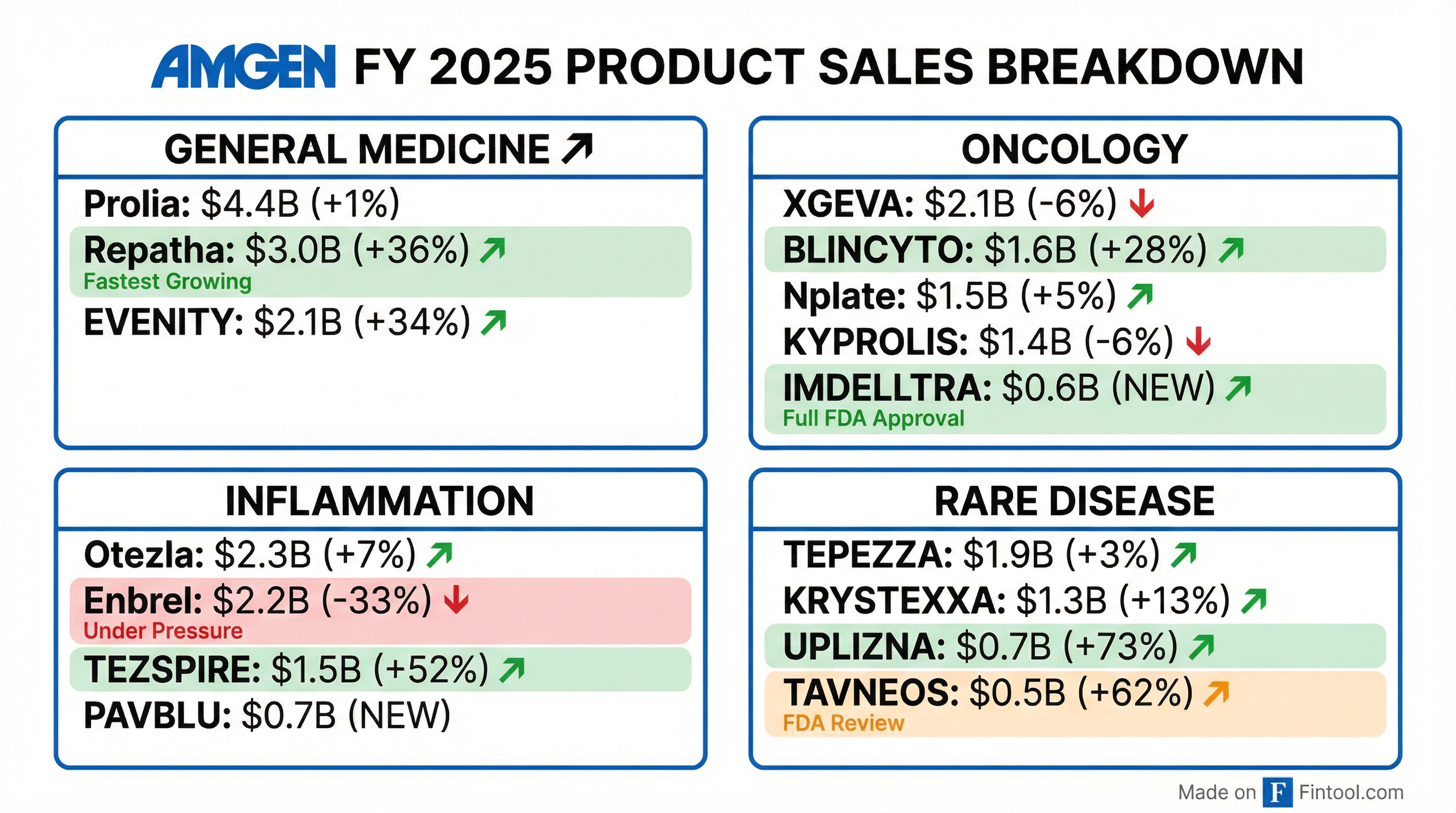

General Medicine (~$11B FY 2025)

The cardiovascular and bone health portfolio delivered strong results:

What to Watch: Repatha's VESALIUS-CV data showing 25% reduction in 3-point MACE and 36% reduction in heart attacks positions it for potential label expansion to primary prevention. Further analysis on the diabetic subgroup coming at ACC in March 2026.

Inflammation (~$7B FY 2025)

TEZSPIRE and Otezla drove growth while legacy Enbrel continued to decline:

What to Watch: TEZSPIRE Phase 3 studies in COPD and eosinophilic esophagitis could significantly expand the addressable market.

Rare Disease (~$5B FY 2025)

Horizon-acquired assets continue to perform well:

⚠️ Tavneos FDA Alert: On January 16, 2026, the FDA requested a voluntary withdrawal of Tavneos. The agency raised concerns about a process followed by ChemoCentryx (acquired by Amgen in 2022) to readjudicate primary endpoint results for 9 of 331 patients in the ADVOCATE Phase 3 trial. Management stated they were "surprised by this" and are in ongoing discussions with FDA. Despite this, management remains confident in Tavneos's clinical efficacy, citing real-world evidence and favorable benefit-risk profile.

What to Watch: UPLIZNA received FDA approval for gMG in December 2025, with early physician response strong across both bio-naïve and switch patients. Two pivotal studies expected to initiate in 2026: autoimmune hepatitis and chronic inflammatory demyelinating polyneuropathy (CIDP), a disabling immune-mediated neuropathy.

Oncology (~$10B FY 2025)

BLINCYTO and IMDELLTRA drove growth while legacy assets faced headwinds:

What to Watch: IMDELLTRA received full FDA approval in November 2025 and is now pursuing LS-SCLC and first-line settings. Xaluritamig Phase 3 studies in mCRPC are enrolling.

Pipeline Catalysts

Amgen advanced its pipeline significantly in 2025 and enters 2026 with multiple near-term catalysts:

MariTide (Obesity) — Phase 3

- Six global Phase 3 studies now enrolling

- MARITIME-1/2: Chronic weight management (±T2D)

- MARITIME-CV: Cardiovascular outcomes

- MARITIME-HF: Heart failure

- MARITIME-OSA-1/2: Obstructive sleep apnea

- Part 2 Phase 2 data: Most participants maintained 15%+ weight loss for additional 52 weeks on lower monthly or quarterly doses

- T2D Phase 3 initiation expected 2026

Maintenance Dosing Opportunity: On the Q&A, management emphasized MariTide's potential for monthly, every-8-week, or quarterly dosing to maintain weight. Dr. Jay Bradner pushed back on the assumption that less frequent dosing trades off efficacy: "Having observed the large majority of patients maintaining weight on low dose and on quarterly dosing... I wouldn't necessarily assume that we'll see a big trade-off with less frequent dosing of MariTide."

Obesity Pipeline Depth: Beyond MariTide, management disclosed AMG 513, another clinical-stage obesity asset with an undisclosed mechanism currently in Phase 1. They also noted "exciting" preclinical programs that include both incretin-based and non-incretin-based medicines, as well as injectable and oral formulations.

Olpasiran (Lp(a)) — Phase 3

- OCEAN(a)-Outcomes: Secondary prevention CV outcomes (ongoing)

- OCEAN(a)-PreEvent: Primary prevention (enrolling)

Other Key Programs:

- Dazodalibep (Sjögren's): Two Phase 3 studies, completion H2 2026

- TEPEZZA subcutaneous: Phase 3 completion H2 2026

- TEZSPIRE EoE: Phase 3 completion H2 2026

- Xaluritamig (mCRPC): Two Phase 3 studies enrolling

Pipeline Setbacks:

- Rocatinlimab (atopic dermatitis): Program terminated, returned to Kyowa Kirin

- Bemarituzumab (gastric cancer): First-line development stopped after Phase 3 miss

Capital Allocation

Amgen continues to prioritize debt reduction following the Horizon acquisition:

Q&A Highlights

On Repatha primary care opportunity: Murdo Gordon noted that ~40% of Repatha prescriptions were already coming from primary prevention patients before VESALIUS data promotion began. He expects this to grow as primary care physicians become "much more intent and aligned to adding Repatha to the optimized statin therapy that most patients are on."

On Pavblu biosimilar competition: When asked about maintaining leadership as other Eylea biosimilars launch in H2 2026, management noted they've established inroads with the largest national retina specialist networks and have "a lot of biosimilar experience" to compete effectively.

On dazodalibep in Sjögren's: Dr. Bradner highlighted both Phase 3 studies are fully enrolled, with the moderate-to-high symptom burden study already complete. Results expected H2 2026, with dazodalibep having been "one of the first medicines ever to improve an SDI score" in Phase 2.

What Did Management Avoid?

A few topics received limited attention:

-

Medicare IRA pricing impact beyond Otezla — Management disclosed the $1.2B Otezla impairment but didn't elaborate on potential IRA exposure for other products in future negotiations.

-

Prolia/Xgeva biosimilar timing specifics — While flagging "accelerated erosion" in 2026, management didn't provide granular expectations for market share loss or pricing pressure magnitude.

-

MariTide Phase 3 readout timing — Despite six Phase 3 studies enrolling, no specific data readout windows were provided.

-

Tavneos FDA resolution path — Beyond stating they are "in discussions with FDA," no timeline or expected resolution was provided for the voluntary withdrawal request.

The Bottom Line

Amgen delivered a clean beat in Q4 2025, capping a strong year of double-digit revenue and EPS growth. The company now has 14 products generating over $1B annually and 18 products that hit record sales in 2025.

Bull Case: Repatha's VESALIUS-CV data and potential label expansion, MariTide Phase 3 advancement in obesity, IMDELLTRA and xaluritamig oncology momentum, improving balance sheet.

Bear Case: Prolia/Xgeva biosimilar erosion accelerating in 2026, 2026 guidance implies limited EPS growth, IRA pricing pressure on Otezla and potentially other products, MariTide Phase 3 execution risk.

The after-hours rally suggests the Street is comfortable with the results. With the stock trading at ~15x forward earnings vs. pharma peers at 13-18x, Amgen appears fairly valued pending MariTide catalysts.

Next Earnings: Q1 2026 results expected early May 2026.

Full earnings materials: Q4 2025 Transcript | 10-K Filing